Article by Derik Suria’24

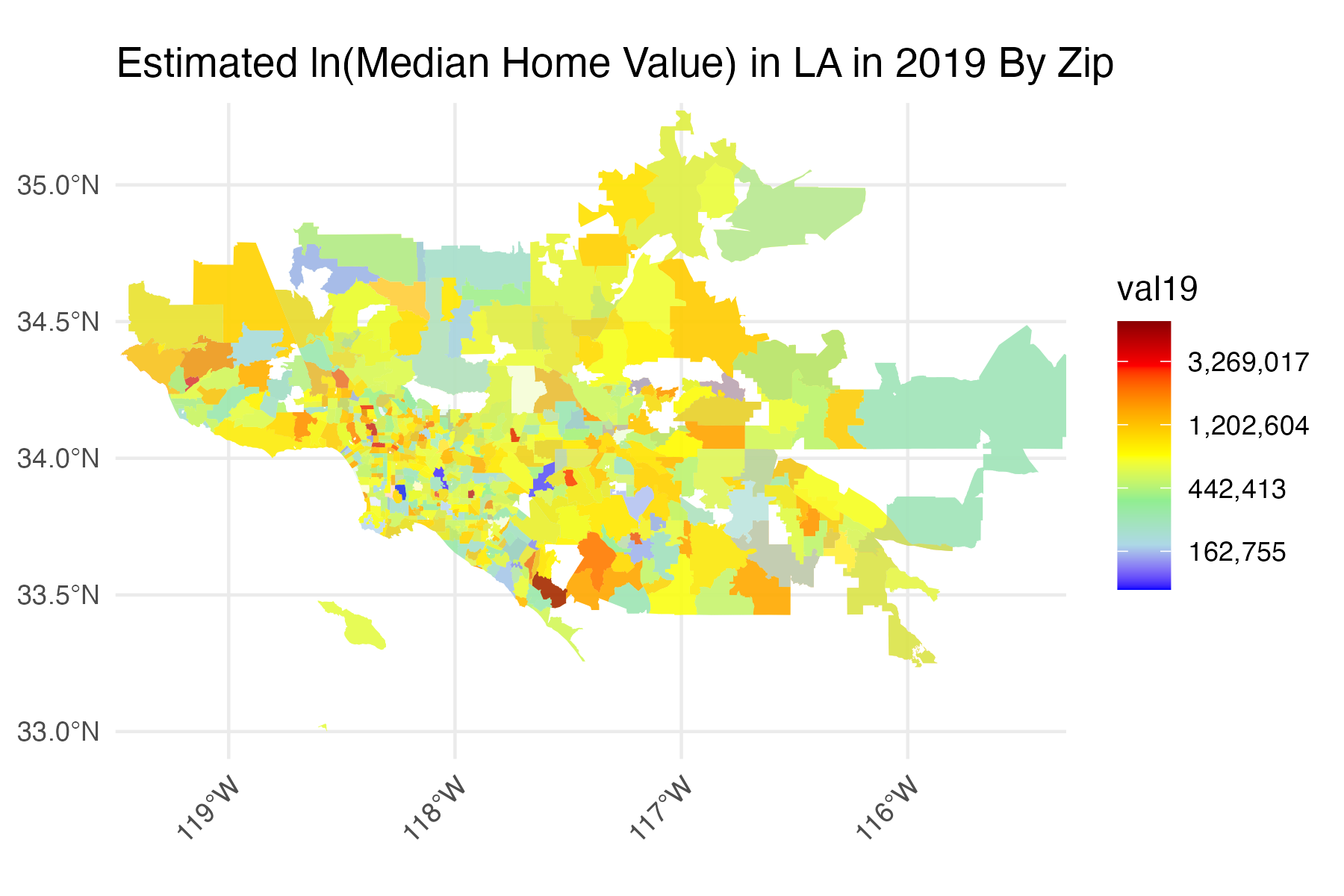

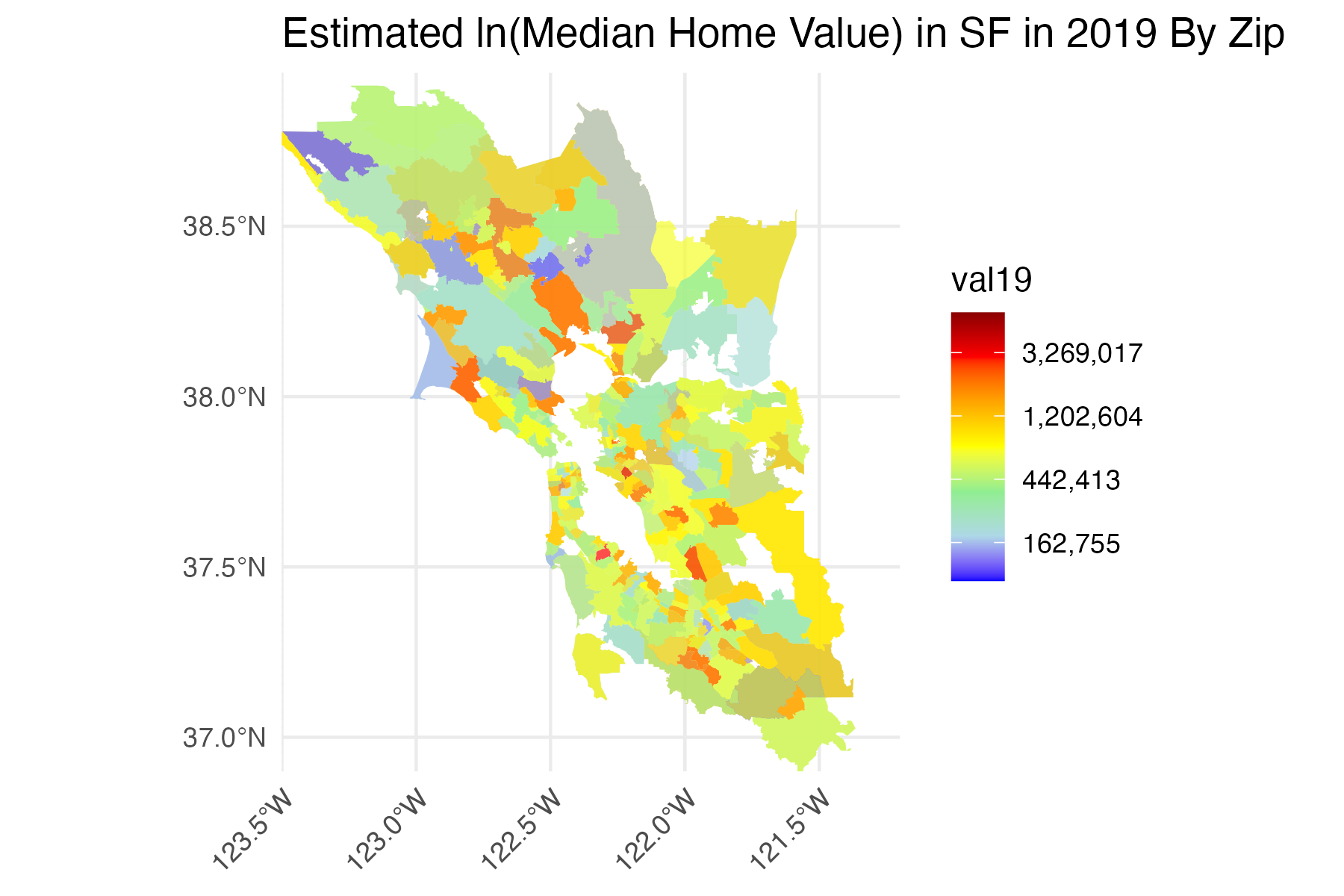

Figure 1 and 2: Estimated Log-Transformed Median Home Value in SF/LA in 2019

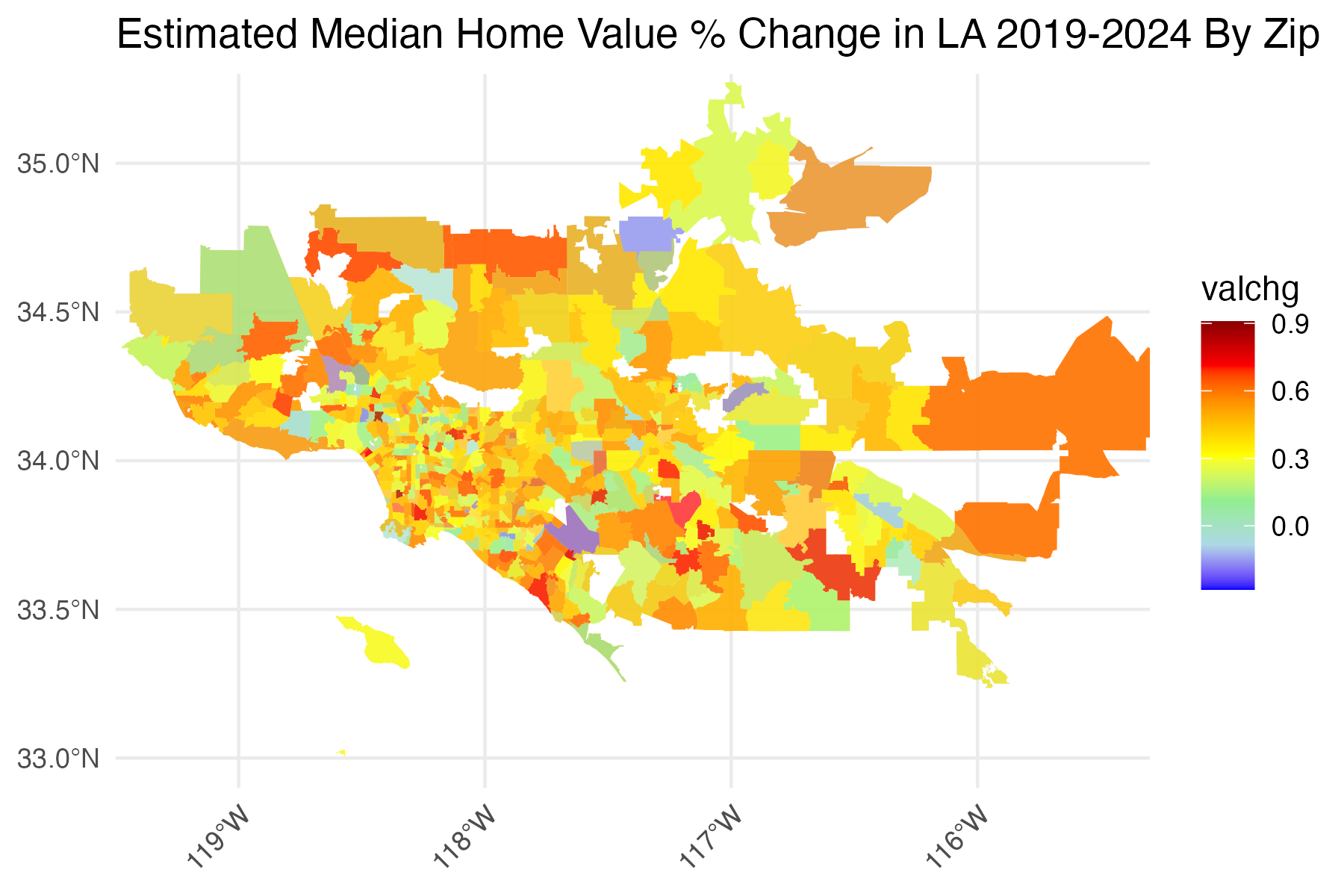

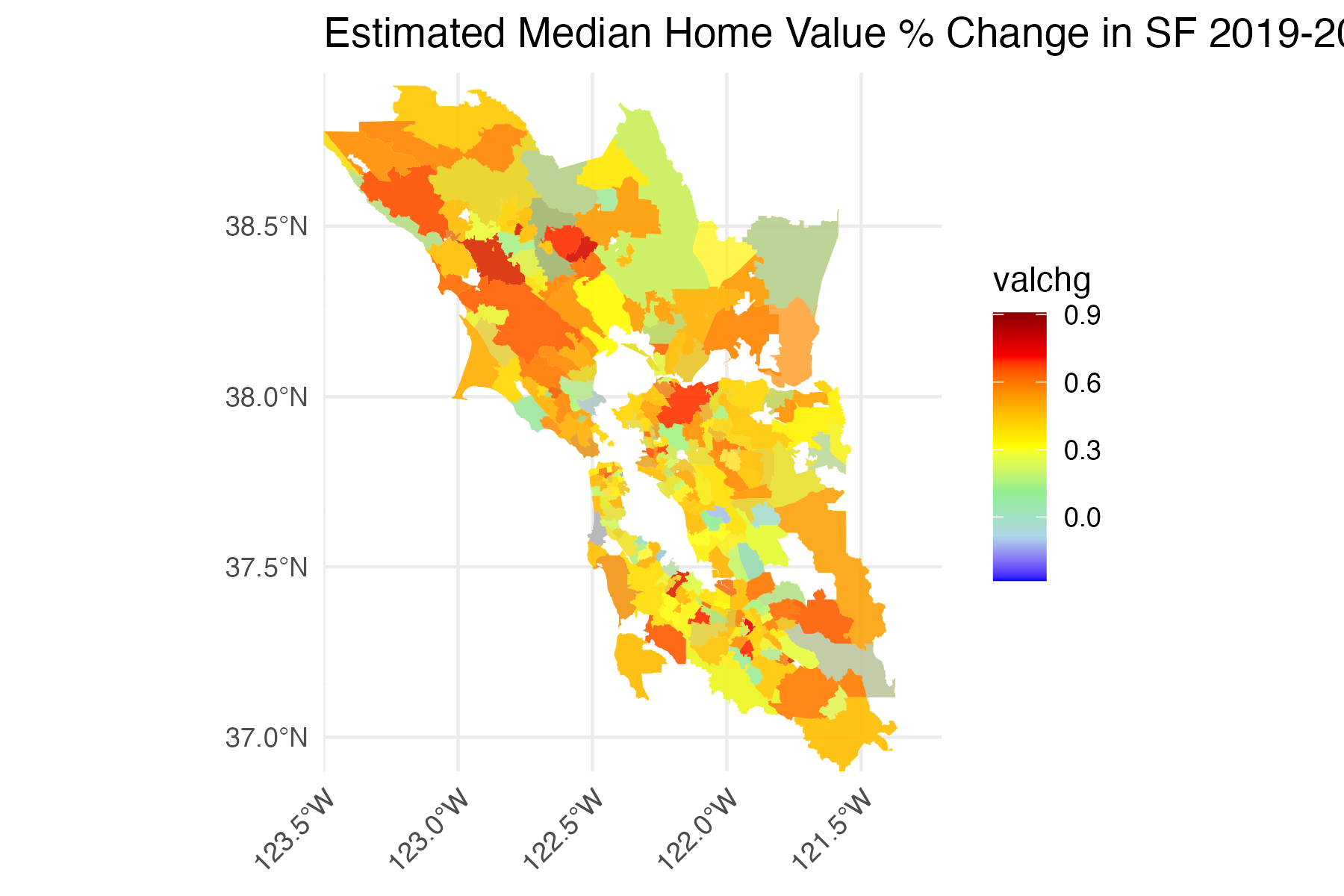

Figure 3 and 4: Estimated Median Home Value % Changes in SF/LA in 2024

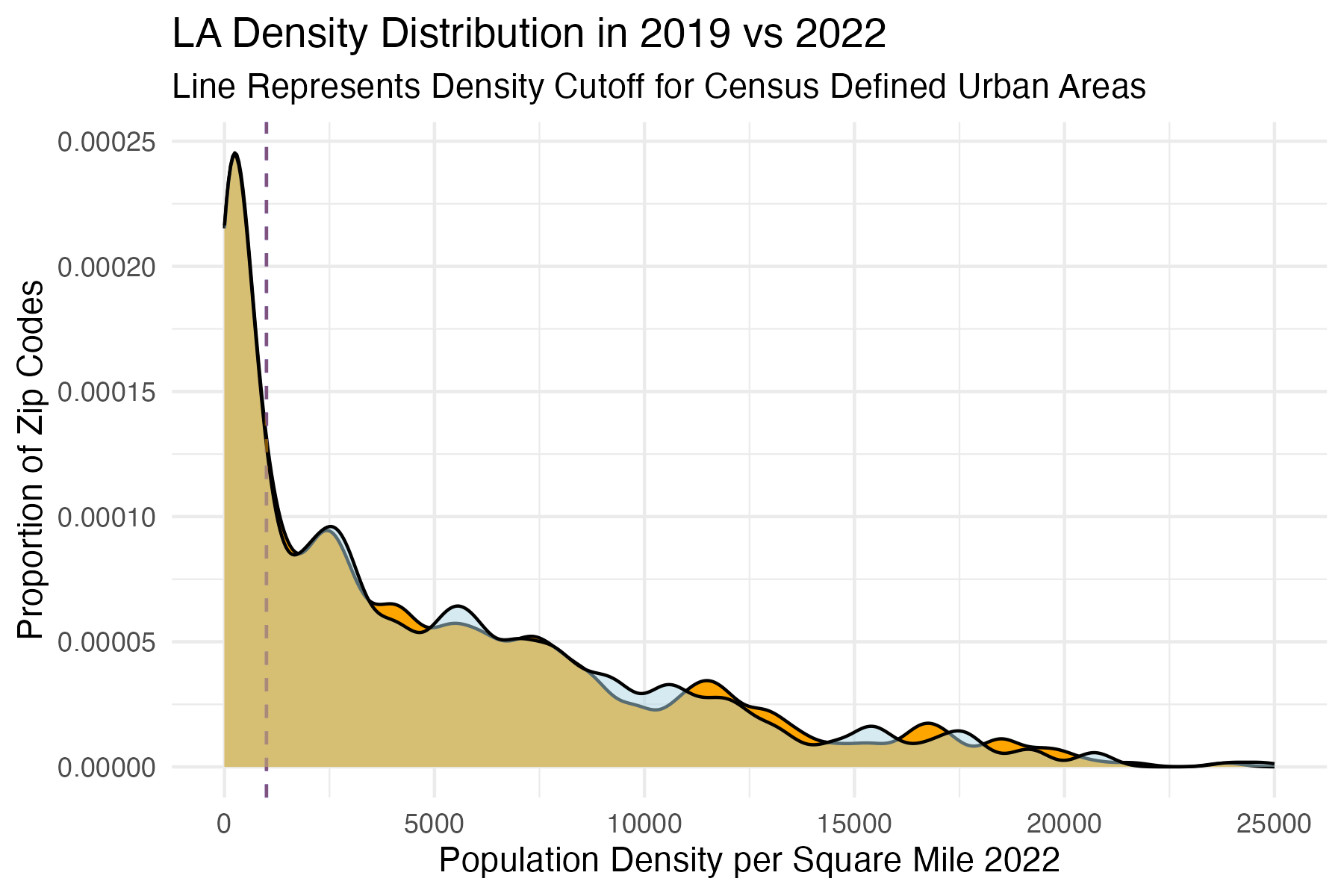

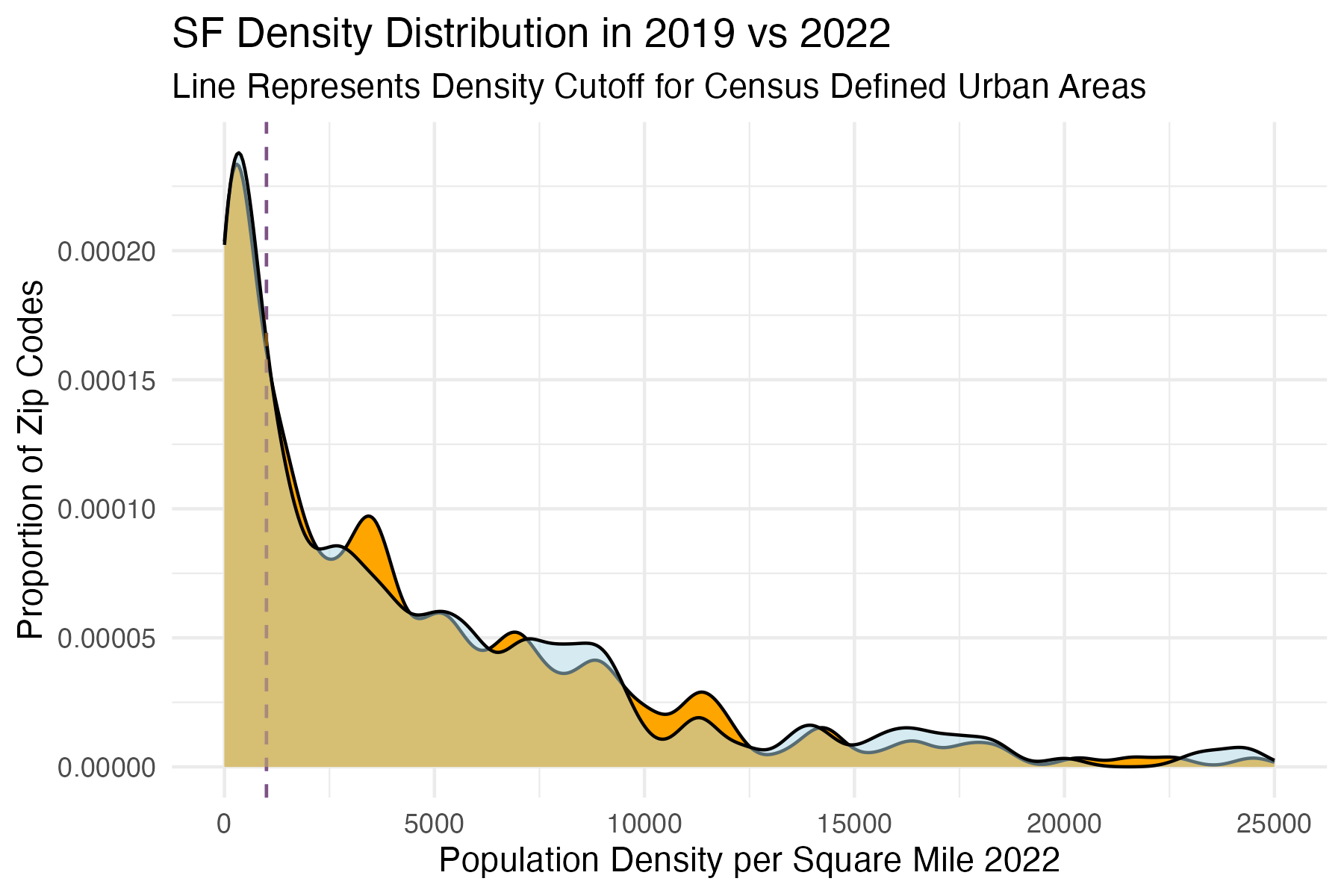

Figure 5 and 6: Comparing Population Density Change in SF/LA 2019 – 2022

– Note: Orange = 2019, Blue = 2022

The COVID-19 pandemic drastically changed the perception of home and community,

especially in California’s urban hubs like Los Angeles and San Francisco. The dominant

narrative is that neighbourhood with easy access to the outdoors or that have maintained

community engagement amid the rise of working-from-home have experienced strong increases

in property values. Meanwhile, areas once reliant on commuters and nightlife have experienced

less predictable market reactions as a general rise in prices due to overall housing scarcity is

muted by slackening local demand. I test this narrative by analysing zip-code level home price

data from the SF and LA metropolitan areas for 2019 and 2024. While home values have

appreciated almost everywhere, the pattern does support the narrative of demand shifting from

urban core to parks and local community.

In SF and LA, both core urban (Mission, Echo Park) and near-urban areas (Outer Sunset,

Silver Lake) saw price appreciation. But, the near-urban areas saw greater appreciation than the

core urban areas while the downtown areas experienced an outright decline. Los Angeles’s core

urban areas (ie. Downtown and Echo Park) experienced a 12% decrease in median home values.

This decline stands in contrast to the suburbs like the San Fernando Valley, which saw

appreciation rates between 18 – 22%. In terms of population change, Downtown LA saw up to a

10% decrease, while areas like Silver Lake witnessed a 2 – 3% increase. Neighbourhoods enriched

by green spaces –like those surrounding Griffith Park–significantly outperformed the broader

market with a 25% increase in home values. In San Francisco, a similar trend emerges. San

Francisco’s urban core and encompassing neighbourhood like the Mission District saw an 8% rise

in home values, while outlying districts such as the Outer Sunset saw increases up to 20%.

Central districts experienced up to an 8% drop in population, reflecting the high cost of living

and shifting lifestyle preferences. However, areas that balance residential appeal with urban

convenience, like Noe Valley, enjoyed up to a 15% growth in population and nearly a 20% surge

in property values.

As individuals change their neighbourhoods preferences, the housing market reflects these

adjustments. These price shifts, enduring beyond the end of the pandemic, seem to indicate a

reimagining of urban life with cities evolving in response to the pandemic’s immediate

disruptions amid an ongoing evolution to changing residential preferences. The coming years

will show whether these short-term changes were temporary or foreshadowed a new paradigm

for urban environments.

Article by Lowe’s Economic Journalist

Derik Suria’24