By Aaria Chandwani

By Aaria Chandwani

Foreign workers play a vital role in the U.S. labor market, especially in science, technology, engineering, and mathematics (STEM) fields. Each year, U.S. employers seeking highly skilled international professionals compete for a limited number of H-1B visas. These short-term, nonimmigrant visas grant U.S. companies access to highly skilled international talent, typically for an initial span of three years. The uncertainty behind visa policies is a cause for anxiety among international students and workers. Drawing on data from the Department of Labor and the Census, this article unpacks the demographic landscape of H1-B holders and examines whether shifts in the local unemployment rate affect the local demand for skilled international professionals.

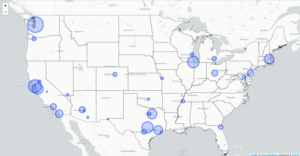

Figure 1 shows the geographic concentration of H1-B visa demand. Certain locations, such as Austin, Seattle, and San Francisco, stand out with the biggest bubbles, indicating the highest population of H1-B demand. The geographic concentration in these key hubs for tech and innovation highlights their strong reliance on international talent to fill specialized roles.

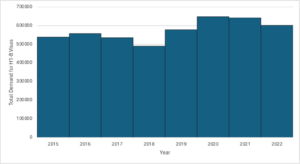

Figure 2 illustrates how H-1B visa demand has evolved from 2015 through 2022. The demand for H-1B visas remains relatively constant over the years despite changes in economic conditions and political power. Even when President Trump signed an executive order that mandated increased scrutiny of H-1B visa applications, pushing the denial rate to a record 24% in 2018—the demand remained consistent, demonstrating the reliance of companies on international workers.

Meanwhile, the acceptance rate for a typical H-1B worker is determined by a lottery system, where the number of applications far exceeds the annual visa cap. The annual supply of H-1B visas has long been capped at 85,000, with 20,000 of these reserved for individuals holding a U.S. master’s degree or higher.

I plot applications from a metropolitan area in a given year against the local unemployment rate for that year to understand whether scarcity of local labor is a driver of demand for foreign workers (Figure 3). While this unemployment rate is not specific to the high-skill workers in question, the lack of a correlation between local unemployment rates and H-1B visa demand underscores a deeper reality—businesses continue hiring international workers regardless of economic downturns. This suggests that labor market debates should extend beyond short-term unemployment metrics to recognize the structural reliance of certain industries on skilled foreign talent.

A broader question emerges: Do H-1B workers compete directly with American workers? If so, shifts in local labor availability should impact application trends. Yet, the data tells a different story—H-1B applications remain stable over time, unaffected by unemployment rates. Instead, fluctuations align more with changes in filing costs and regulatory uncertainty than with actual labor demand. National time series data further supports this, revealing a steady employer demand that persists despite economic fluctuations.

While these findings are significant, it’s important to note a few limitations. Overall unemployment is driven by lower-skilled jobs, making it less representative of the labor market dynamics affecting H-1B visa holders. A better measure would be the college-educated unemployment rate, which is more stable and relevant to H-1B workers. The supply cap on H-1B visas could also be influencing the expressed demand. Although this city-level analysis finds no significant link between H-1B applications per capita and unemployment, industry-specific hiring trends may reveal hidden correlations. Nonetheless, my findings raise doubt that H-1B visas take jobs from native-born workers.

|

Article by Aaria ’27 Data Journalist |

|