Article by Armine Kardashyan and Weston Crewe

Days before the US was expected to have its first ever default, Congressional Republicans and the White House negotiated a deal that lifted the debt ceiling and cut government spending. This was in part because the Congressional Budget Office (CBO) projections showed substantial deficits for the foreseeable future. The CBO is seen as the gold standard for policymakers who rely on their budget and economic projections for policy and negotiations. Despite the trust they have put in the CBO to guide them in these decisions, the data we have gathered shows that the deficit picture of the status quo is likely worse than it seems.

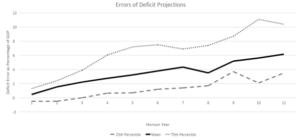

Every year, the CBO publishes a forecast of the expected path of the budget deficit over the next ten years. Using data from 1976 to 2022, we compared the CBO forecasts over a ten-year horizon to the actual deficit numbers as they occurred over the next ten years. The consistently positive forecast errors (Figure 1) are evidence that past CBO estimates have been too rosy as the actual deficit was almost always greater than projected.

Figure 1: Error Graph of Deficit Projections

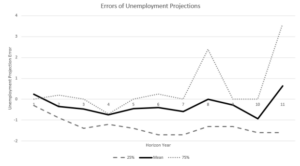

There are four factors contributing to the errors in deficit predictions— technical, legislative, economic, and political. An incorrect forecast of the underlying macroeconomy will lead to mistaken forecasts of tax receipts and safety net payments. While CBO forecasts of unemployment (Figure 2) are, on average, a half point too optimistic, this is a relatively minor error responsible for a small fraction of the consistent errors noted in Figure 1.

Figure 2: Error Graph of Unemployment Projections

Moreover, GDP is not persistently over-predicted, so over-optimism regarding the base of taxable income is not part of the story.

One significant source of uncertainty is new legislation changing taxes, benefits, and other fiscal obligations. The CBO does not attempt to project legislative adjustments, but simply projects the incidence of current legislation. Despite being a nonpartisan entity, the CBO may also emphasize best-case scenarios so as to keep peace with its paymasters.

Whatever the source of the optimistic bias, the persistent underestimates potentially mislead politicians into making sub-optimal decisions. If the forecasts are significantly off the mark, policymakers may implement inappropriate measures that worsen economic conditions. Budget tightening, already rare and usually failing to hit the mark, may be doubly doomed by an underestimate of the scope of the problem.