After the COVID-19 pandemic, criticism regarding the Federal Reserve’s forecasting capabilities of economic variables has increased. From Wall Street CEOs like Jamie Dimon to think tanks like The Hoover Institution, the consensus has been that the Fed’s human and institutional errors not only create inaccurate forecasts but that these forecasts lead to bad monetary policy. Using data from the 1970s to 2018, we compared the Federal Reserve’s forecasts to the median forecast from the Survey of Professional Forecasters’s (SPF), considering both Next Quarter (3 months ahead) and 1-Year (12 months ahead) horizon forecasts for rates of unemployment, inflation, and economic growth. By analyzing the two sets of forecasts, we were able to conclude several things– the Fed and the SPF forecast errors are generally smaller for short-term projections than they are for long-term projections, errors spike around the times of recessions, and Fed forecasts are approximately equal in quality to those crowd-sourced from a stable of professional private forecasters.

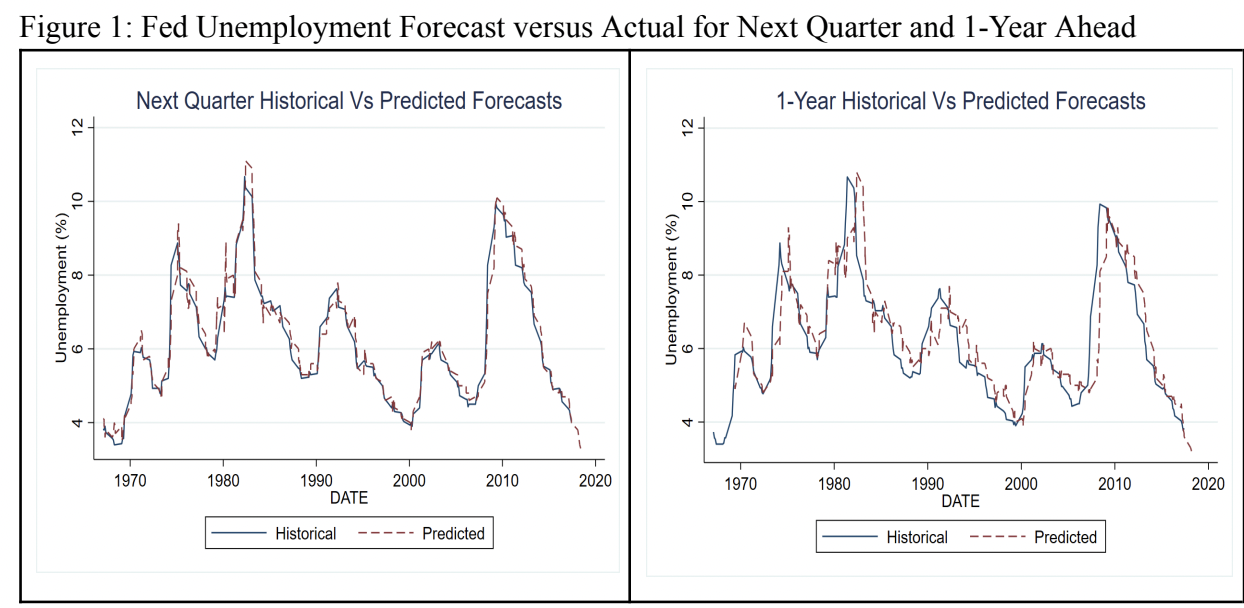

All forecasts naturally decline in accuracy the longer the horizon. As the time horizon extends further into the future, the potential for unanticipated shocks increases with changes in government policies, global economic and political trends, or black swan events. We can see this clearly by comparing Fed forecasts of the unemployment rate at two horizons: 3 months ahead and 12 months ahead. This same trend is noticed in the graphs made with the forecasts from the SPF.

While the Fed’s and SPF’s Next Quarter forecasts of the unemployment rate are highly accurate across various economic phases over the years, the 1-Year ahead forecast is more noticeably distinct from the historical values. At the shorter horizon, the realized data tightly confirms the predictions whereas with the longer horizon, the predictions are clearly lagging behind, reacting to, rather than anticipating, shifts in economic conditions.

The same pattern is seen with inflation and economic growth but these two economic variables are significantly more volatile than unemployment. This volatility creates more uncertainty in projecting which is realized by the more inaccurate predicted values, though the predictions do accurately track the lower-frequency movements (the general trend).

Another challenge with forecasting is accurately pinpointing recessions. Forecasts are based on past observed behavior and recessions have only occurred less than two dozen times in the economy since WW2. Since this is such a small sample, it will be hard to base a forecast off of this data and accurately predict recession times. The saying “past performance is not a guarantee of future performance” represents this dilemma nicely since all that forecasting is based on is past performance. If recession data is a small sample, the likelihood of forecasting a recession is also small.

In all three variables, the peaks in forecast errors— the difference between actual and historical values— occur during recession years: 1975, 1981, and 2007. So it is true that neither the Federal Reserve nor the Survey of Professional Forecasters are able to predict the timing of recessions, making this a phenomenon that is not exclusive to the Fed.

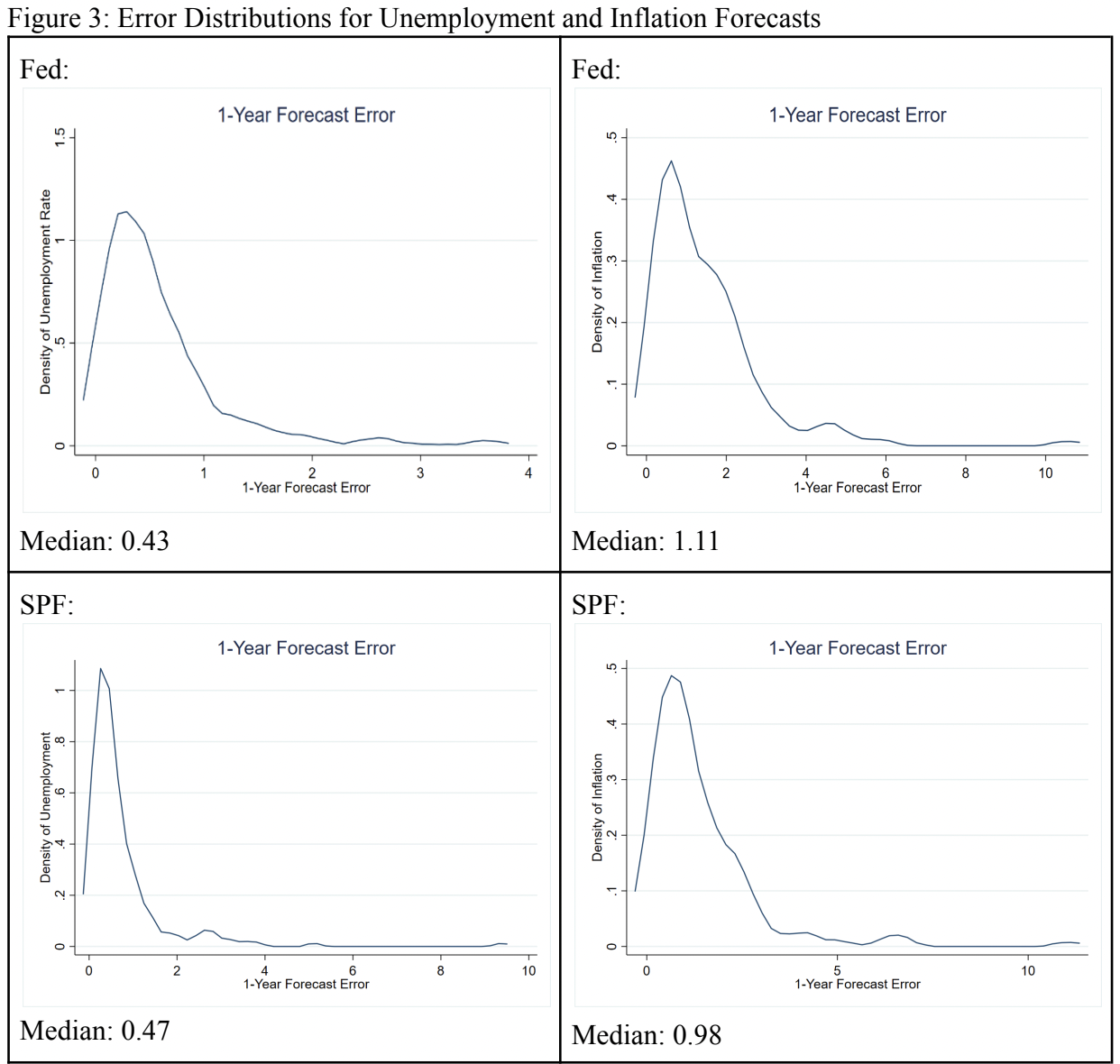

Given increased errors in long-term forecasts and an inability to accurately predict recessions, how does the Fed do on average, using the median of the SPF forecasts as a comparison? To answer this question and understand the relative accuracy of the Fed forecasts, we examined the distribution of forecast errors for the Fed and the SPF. This was done by plotting error distributions for both the Next Quarter and 1-Year forecasts and calculating the median errors.

Forecasts of the unemployment rate have smaller errors than the other two variables. The smaller errors in unemployment could be attributed to unemployment’s relatively slower and more gradual response to changes in economic conditions compared to inflation and economic growth.

The Fed does a better job than the SPF of predicting unemployment but this is not the case for inflation and economic growth. The SPF does a slightly better job of forecasting growth since its median error is 1.67 compared to the Fed’s median error of 1.68. The SPF also does a better job at forecasting inflation with a median error of 0.98 to the Fed’s 1.11. These differences are not large, suggesting little difference between the average of professional forecasts and the Fed’s own forecasts. This may be due to the wisdom of the crowds, as the SPF benefits from a multiplicity of models. It may also be a result of the Fed’s success in communicating its own future intentions, allowing private forecasters to accurately predict the Fed’s response and include it in private forecasts. It is also possible that SPF forecasts incorporate Fed forecasts rather than being wholly independent. In any case, while Fed forecasts are not obviously superior, conveying private information or better modeling, they are not so poor as to be misleading or obsolete in helping understand the moderate fluctuations within a phase of a business cycle.

Article by

Abizer Mamnoon’25

Armine Kardashyan’26