Article by Abizer Mamnoon and Anahitha Gopikumar

Ontario Airport (ONT), located east of downtown Ontario in San Bernardino County, is the geographically closest airport to the Claremont Colleges. Used regularly by students, staff, and faculty, the community has a great interest in its success as measured by the breadth of destinations and frequency of flights. In November 2016, ownership of ONT was returned to the Inland Empire from LA County. By examining cargo volume, domestic and international passenger traffic, and the resulting financial implications, we show that the Ontario Airport has performed significantly better under local management.

In 1985, the airport entered a 30-year ownership agreement with Los Angeles County in the hopes that its vast financial resources would boost the airport’s passenger traffic and strengthen relationships with well-established partner airlines. Unfortunately, the new management practices did not satisfy Ontario’s hopes, leading ONT to sue the Los Angeles management for violating their agreement. In retort, Los Angeles stated that the significant loss in business resulted from the 2008 recession rather than administrative negligence. After a period of power struggle back and forth, it was decided that ownership of ONT would be returned to the Inland Empire, with the official transfer taking place in November 2016.

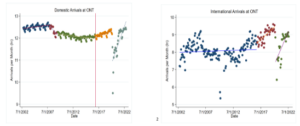

We first analyze air traffic statistics before and after the acquisition. Domestic flights make up the majority of all flights across all years between 2002 and 2022. In the graphs below, we run a linear regression and apply the best-fit line to the data points before and after the acquisition. We try to understand how the trends in domestic arrivals/departures and international arrivals/departures have changed before and after the acquisition.

Both domestic and international departures/arrivals see the same trends so we focus only on the arrivals data.

Overall domestic arrivals had a downward trend until before the acquisition. Until the recession, LA County managed ONT well and 0.26% more passengers were arriving at ONT every month. Naturally, during the recession, fewer people were traveling to save money, so ONT experienced a 2.31% monthly decline from December 2007 to June 2009. However, the downward trend continued years after the recession as 0.23% fewer passengers were arriving at ONT every month. In comparison, international arrivals at ONT had an inconclusive trend before the acquisition.

Overall domestic arrivals had a downward trend until before the acquisition. Until the recession, LA County managed ONT well and 0.26% more passengers were arriving at ONT every month. Naturally, during the recession, fewer people were traveling to save money, so ONT experienced a 2.31% monthly decline from December 2007 to June 2009. However, the downward trend continued years after the recession as 0.23% fewer passengers were arriving at ONT every month. In comparison, international arrivals at ONT had an inconclusive trend before the acquisition.

Under the management of the Inland Empire, ONT has seen an upward trend in both domestic and international arrivals. Each month after the acquisition, 0.68% more passengers landed in ONT through domestic flights. In comparison, each month after the acquisition, 2.4% more passengers landed in ONT via international flights. Even after the huge shock in passenger numbers during the pandemic, ONT bounced back very quickly as 5.74% more passengers were arriving via domestic flights and 6.1% more passengers were arriving via international flights every month.

Having seen the inbound/outbound passenger statistics for ONT alone, we analyzed how ONT compares to other major airports within a 50-mile radius in the same time period. LAX has more domestic departures/arrivals and international departures/arrivals than the other four airports combined. In terms of domestic departures or arrivals, John Wayne comes second, followed by ONT and Bob Hope. The rankings have not changed since the acquisition.

International traffic offers a more dynamic picture. Between 2012 and the acquisition, John Wayne rose to become dominant in international flights compared to ONT, Long Beach, and Bob Hope. After the acquisition, the Inland Empire focused on increasing international flights to and from ONT with the result that ONT and John Wayne are now evenly matched

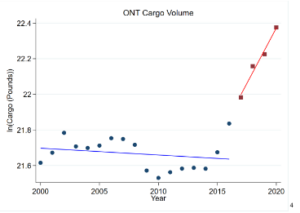

We then analyzed cargo data from ONT:

Before the Inland Empire’s acquisition of ONT, ONT’s cargo volume had declined slightly following the Great Recession, recovering to the prior level only by 2016. After the acquisition, there has been a strong positive trend in cargo volume, with the cargo volume increasing by 12.5% each year. Before the acquisition, ONT was ranked 12th among the largest cargo airports in the United States. Under the leadership of the Inland Empire, ONT is now ranked 9th.

The growth in international traffic and cargo volume has greatly improved the bottom line. While operating profit was essentially zero in the first two years of local control, operating profits in 2022 were a healthy 18.2% of revenues.

To conclude, Ontario Airport has delivered sustained success since the return of control to the Inland Empire. ONT experienced a clear rise in domestic and international passenger traffic following the acquisition, becoming an international airport on par with John Wayne. At the same time, cargo volumes rose significantly in the years following 2016. In addition, healthy operating revenues suggest our local airport has filed a favorable flight plan.

This triumph can be attributed to the release of Ontario from the monopolistic practices of the Los Angeles Management, which prioritized business to their central airport, LAX, as opposed to using their wealth of resources to support ONT, as promised. Specifically, the management organized incoming demand by directing a bulk of the traffic to LAX and relying on Ontario to manage the excess demand once LAX was at full capacity.

The adverse effects of this phenomenon mirror the beliefs of English economist, John Stuart Mill. He believed that monopolistic practices lead to economic inefficiencies, a reduction in consumer choice, and, most importantly, an abuse of power by the dominant entity; these ramifications explain why ONT has seen significant success since its release from the acquisition. The Inland Empire management is able to prioritize ONT by allowing it higher passenger traffic and, therefore, allowing the population of the metropolitan area a larger variety of convenient flight options. The local management is focused on satisfying local demand and both the airport and the local community are profiting from it.