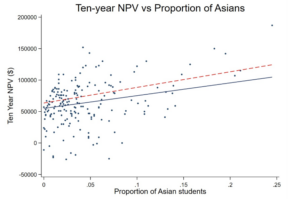

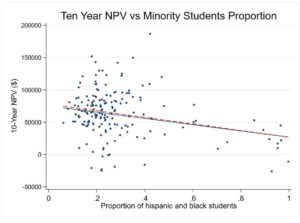

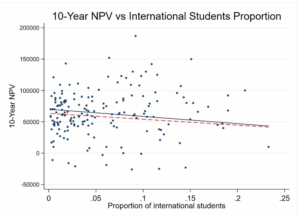

In a Georgetown study, researchers collected the 10-year net present value (NPV) of a degree from each of 210 liberal arts colleges. While the median 10-year NPV of a liberal arts degree ($54,400) is significantly lower than that of an engineering degree ($72,200), there are many liberal arts colleges with high NPV, such as Claremont McKenna College ($87,000). What are the markers of a high NPV liberal arts college? I found that, among coed liberal arts colleges, 10-year NPV is higher where there are more Asian students and male students and lower among colleges with more international students, Hispanics, or blacks.

These results are statistically significant correlations I derived from a multiple-regression so they do not establish the direction of causality. Yet they form an interesting set of results over which we can speculate about causes.

Increasing the fraction of the class identifying as Asian by 10 percentage points is associated with a $200K rise in the 10-year NPV. Part of the story seems to be the choice of major. Controlling for the fraction of the graduating class that earned STEM degrees reduces the strength of the association between Asians and NPV by 18%. Colleges with many STEM majors have a higher NPV and more students of Asian descent. On the other hand, a higher proportion of Hispanics and Blacks is associated with a $50K decrease in 10-year NPV. One might assume that the negative association is because blacks and hispanics go to lower-ranked liberal arts colleges, so they have a lower quality of education. However, the ranking does not have a significant association with the median ten-year return on investment of liberal arts colleges. Controlling for the ranking of the liberal arts college, only diminishes the strength of association between ten-year ROI and hispanics and blacks by 6%. Neither college rank nor choice of major explains these associations between NPV and the ethnic composition of the student body.

Increasing the fraction of international students by 10 percentage points is associated with a $115K drop in ten-year ROI. One might hypothesize that colleges intake more (generally full-paying) international students if they have a lower endowment and colleges with a lower endowment are associated with a lower ten-year return on investment. However, controlling for endowment per student increases the negative association by 22%.

An alternate possibility explains the negative NPV as a result of immigration patterns. International students find it more challenging to secure a job in the US because companies do not want to sponsor international students after their visa expires in 1-3 years based on whether they have a STEM degree or not. As a result, a lot of international students go back to their home countries, such as India or China, where their yearly income is probably lower and grows at a slower rate than it would in the US.

Through my research, I found that many of the associations one would typically expect for the ten-year NPV are not there. For instance, one would typically expect black and hispanic students to have a lower ten-year NPV because they go to lower-ranked schools, but that seems to explain very little of why they have a lower return on investment from liberal arts colleges. Further study needs to be done to study whether these associations could be a consequence of other factors, such as the types of careers and majors liberal arts colleges choose to pursue

Article by Abizer Mamnoon’25

Economic Journalist – Lowe Institute of Political Economy at Claremont McKenna College